Money is important – that’s a given. Yes, not everything is about money, but let’s face it, a lot of it is! Money, and by extension, some means to earn it, is absolutely needed. But, unfortunately, we all too often let Money take over our lives. Financial balance is when we make the money work for us and not the other way around. Here are a few tips that can help you get started.

Start saving early

Starting early allows us to harness the power of compounding. Even a measly 5% interest on a deposit of Rs. 10,000 will grow to Rs. 25270 in 20 years. That’s a 150% increase! You can do better by adding Rs. 10,000 each year. That will result in almost Rs. 3,31,000 over 20 years. That’s an increase of over 3000%!

So start early – as soon as you possibly can, start a recurring deposit. That’s a easiest option for saving and investing money. It’s not a great return on investment, but it will help you develop the habit of saving. Set it for short term, like monthly or every three months, if you want. You can always stop it whenever needed. How much you start with depends on your net save-able income (NSI). We will cover how to calculate your NSI in a future post but in short, it is how much you realistically save after accounting for all your needs – that is, for example, your living expenses (rent, food, travel) + leisure expenses (movies, outings) + contingencies (emergencies).

Start now!

While starting early is the best approach for a financial secure life, it is never too late to start saving and investing. In that sense, the best time to start is NOW! Do not wait till “things are better”. Chances are, they will not get better for a while. But if you start the process of saving and investing now, it means that you are ready to change your circumstances. It means you are ready to work toward achieving financial balance in your life.

Define financial goals

Goal-setting usually scares people. Most of us don’t like it because it forces us to stop and think. The task of preparing for our future seems daunting. However, it need not be. Goals are best set in a time frame that we are comfortable with. We don’t have to worry about saving for our retirement when we are just starting with our first job. You decide what time frame works for you. One year, 5 years, 10 years, 20 years, 30 years. For example, if you just got your first paycheck, “ek party toh banta hain yaar“! Splurge away if that gives your happiness. ! But then again, you are the boss – you decide. Setting financial goals usually mirror our life goals. As such, for most of us, there are only a few standard milestones – get married, have kid (s), buy a house, car, have a comfortable life, maybe retire early. Along the way we will have additional uses for money such as tuition for kids’ education, nice things for yourself and your spouse, travel and vacation, entertainment etc. Once you have an idea of how you want to spend the money, you work toward making it happen. After all, we earn to live and not the other way around!

Diversify

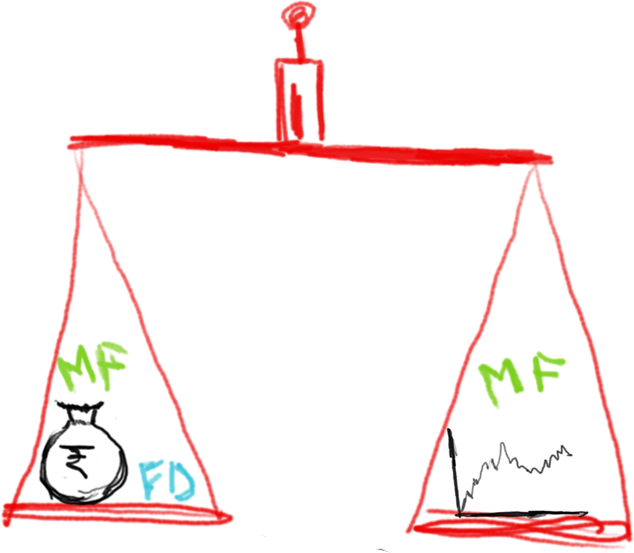

For a common person, not very conversant with the banking sector, there a few options for saving and investing: 1. Fixed Deposit, 2, Recurring Deposits, 3. PPF/ EPF, 4. Mutual Funds, 5. Equity (Share market).

Overall, the investment options come under two headings – Debt and Equity.

Debt means loans. Fixed Deposit, Recurring Deposit and PPF/EPF come under Debt. It means you are giving a loan to the Bank. The banks are clever – they get a loan from us on a low interest, but they use the money to give others a loan on a much higher interest. However, their risk appetite is much higher. Their judgement may be doubtful, given the current NPA situation in the country – still given the size of these institutions, we believe they will not sink. Therefore, relatively speaking, it’s a safe bet that we will get our money back with a small interest added.

The Equity option, on the other hand, can be highly rewarding, but it’s much more riskier. There are high highs, and low lows. Just last week, the markets fell 7%. And today the market is up 4%. If you’ve ever been on a camel ride on Chowpatty beach, you’ll know what I mean. Timing the market is not for most people. A relatively safe way to invest in the stock market is to go with blue-chip stocks and invest for the long term – say for 5 years or more. Short-term returns can be extremely volatile. If you have the risk appetite, and most importantly, if you have the time and inclination to learn the ways of trading, then you can potentially earn substantial returns with trading.

Mutual Funds are offered in both debt and equity. When you invest in a mutual fund, you have to trust in the decisions made by the fund manager. Again, with Debt funds, the risk is low, and reward is also low. With Equity funds, reward may be higher, but risk is definitely higher. There are combination funds as well, which claim to lower your risk – but bottom-line, the more return you want, the greater risk you have to take. Period.

Set risk appetite

Early on when you start earning and you are young, you may be willing to risk your money on the stock market, but remember, it’s difficult to predict superficially. You cannot depend only on stock tips you get on WhatsApp or even by established TV analysts. Of course, it’s not impossible, but it is definitely difficult and requires time to understand how the market works. Moreover, your financial situation may just not allow you to risk money on the stock market for your time-frame. Ultimately, you decide, based on your current financial situation and your financial goals what amount of risk you are comfortable with. In general, a good way to start is to divide your investments into 30% debt, 30% stock and 30% savings account (for emergencies).

Usually, it is advisable to buy insurance – not for investment but for security. Life Insurance helps reduce the risks of financial stress on your family upon your untimely death. Nowadays, Term Insurance is being marketed aggressively and seems like a cost-effective option, but be aware that there are several caveats. Health Insurance may help for major surgeries but not for routine health issues. It’s a travesty how limited the health insurance coverage is in India. But still, for peace of mind, these are the some basic insurance covers you should consider. They are a broad safety net finance-wise.

Overall, you decide your appetite for risk. Cover your bases as much as possible and don’t worry too much as we cannot really foresee everything.

Keep track

One of the most important aspects of financial planning is to keep track of our savings and investments. It is prudent to do this frequently. Again, it is connected to your financial goals. Depending on your time-frame and goals, you decide whether your investments are working for you. Now, for debt-based investments like Fixed Deposits, it is easy to figure out since in most cases you know how much interest you will earn and for what time period. Equity is dependent on your investing style – long-term, medium-term, short-term or day trading. Usually, it helps to have a combined approach. Whatever you do, it is imperative that you create a personal balance sheet at the end of the year – something that works best if you have created an annual budget at the beginning of the year. Of course, the financial year usually is counted from April 1st to March 31st.

Hope this article helped you. May you achieve Financial Balance.

Leave a Reply